Surpassing industry standards to provide the most secure payment processing solution

How CardConnect’s Patented Tokenization Stacks Up

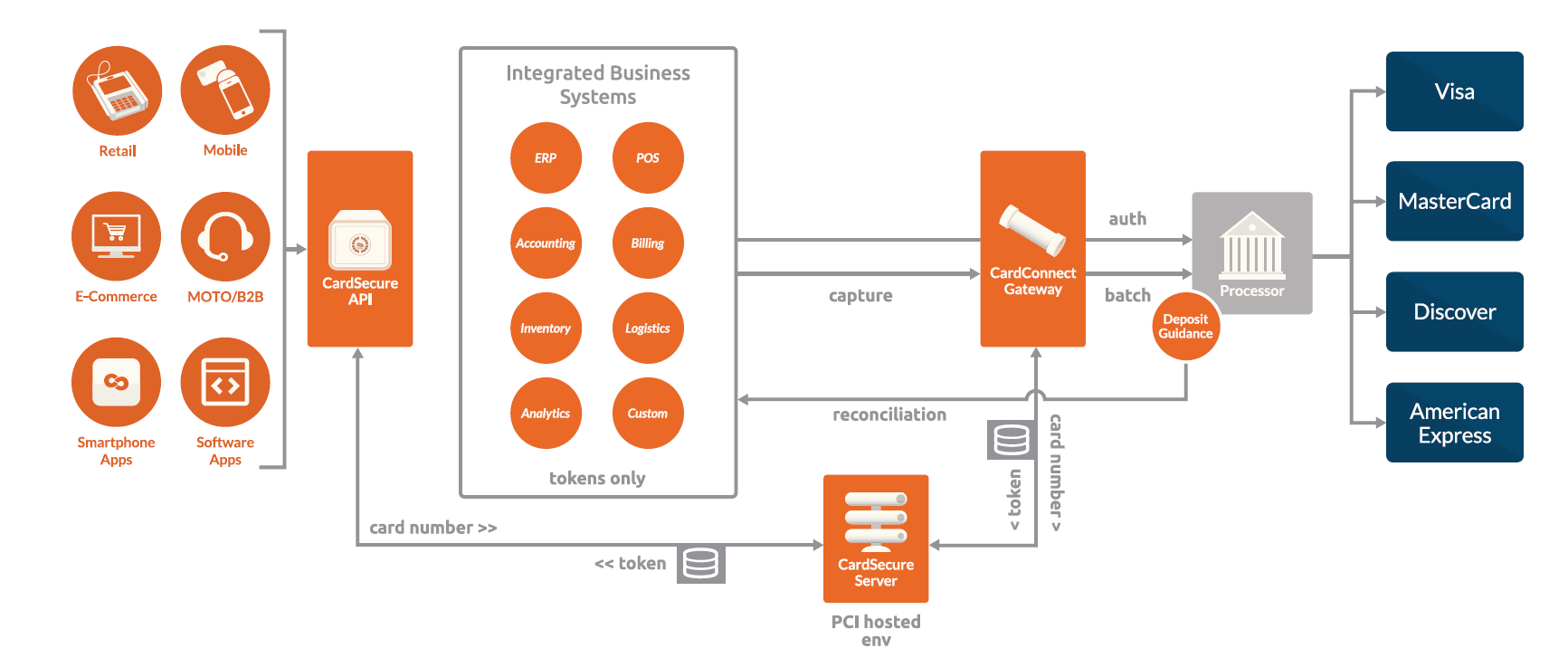

CardConnect’s patented token methods are used to secure omni-channel payment ecosystems, removing PCI scope from all card-present and card-not-present transactions.

Only CardConnect can deploy these security measures in environments where a terminal or device is connected to a software application.

Benefits

CardConnect’s tokenization minimizes the exposure and risk a business has when handling payment transactions

PCI Scope Reduction

A combination of CardConnect’s tokenization and integrated hardware (PANpad and P2PE terminals) help take a business out of PCI scope, greatly reducing requirements and cost of compliance.

.

Merchant Specific Security

While other tokenization methods produce vulnerable multi-use tokens for multiple merchants, CardConnect’s tokens are single use; unique to each merchant and safeguarded against security risks.

Token Intelligence

By passing data integrity checks like the Luhn test, CardConnect’s tokens fit easily in any software environment. They also keep their value for reconciliation reporting by maintaining BIN information and the card’s last four digits.

E-Commerce and API Integrations

Bring the security benefits of CardConnect’s tokenization to any website or software application with our easy-to-use API.

What Our Clients Say

“We had an obligation to ensure our system had the safeguards in place to keep credit card data as secure as possible and PCI compliant. CardConnect provided very competitive pricing and went above and beyond for us during integration.”

Nancy Parillo, CFO, RITBA